The Hydrogen Economy: Making Green Steel Achievable

By Daren E. Daugaard, PhD, PE, Lee Enterprise Consulting

Special to The Digest

Since its inception over 4,000 years ago, steel has been the foundation of global modernization in building construction, transportation, and manufacturing. Steel and iron production ranks first in total global CO2 emissions at 8% and second in overall energy consumption. The industry must pivot aggressively and innovatively to meet modern challenges regarding emission prescribed by the Net-Zero Emissions by 2050 initiative.

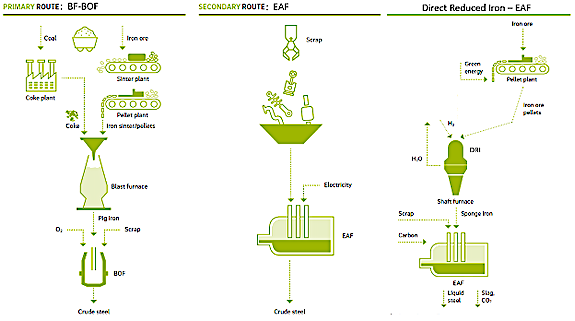

Steel manufacturing is a high-temperature and energy-intensive operation that relies on fossil-based fuels for raw materials (coking coal) and process heat (coal, natural gas, grid electricity). Since WWII, a significant reduction in energy intensity has been achieved by utilizing iron ore pellets, exchanging open hearth processes primarily with blast furnace-basic oxygen furnace (BF-BOF) and secondarily by electric arc furnaces (EAF), obsoleting ingot casting with continuous casting, and increasing the scrap recycling rate [1,2]. The gains in reducing energy intensity have been offset by increased steel demand while CO2emissions average from 1.4 to 1.9 tCO2eq/tsteel in recent times.

Current Initiatives to Net-Zero Emissions

The industry has a multifaceted approach to reducing its carbon footprint by: Improving the energy efficiency of existing infrastructure, increasing secondary production with the use of recycled scrap in EAF, transitioning process heat from fossil fuel to renewable sources, implementing carbon capture utilization and storage (CCUS) technologies, developing hydrogen-based processes, and utilizing biobased carbon sources.

Using secondary production methods with recycled scrap uses about 10% to 15% of the energy consumed in primary production using BF-BOF from iron ore. The energy source for secondary production is primarily electricity for EAFs, versus coal in primary production. Steel has high recycling rates of 80-90% yet recycling alone cannot meet present or future demand.

Steel Producing Pathways

Modified from: [3] Berger, R. The future of steelmaking – How the European steel industry can achieve carbon neutrality. May 2020.

Traditional Steel Production Inputs and Emissions (per tonne of steel)

| Steel Process | Iron Ore | Coal/Coke

Carbon |

Natural Gas | Electricity | Recycled Steel | CO2

Emissions |

World Fraction | |

| BF-BOF (primary) | 1,577 kg | 482 kg | 0.5 kg | 154 kWh | 165 kg | 1.69 t | ~70% | |

| EAF (secondary) | – | 10.4 kg | 28 kg | 623 kWh | 1,116 kg | 0.30 t | ~25% | |

| DRI-EAF | 1,363 kg | – | 221 kg | 452 kWh | 165 kg | 0.74 t | ~5% | |

| Based on: Metals 2020, 10, 331; doi:10.3390/met10030331

Note: Near 0.4 kgH2 to replace 1 kgNatural Gas when decarbonizing the steel process. |

||||||||

The previous table illustrates opportunities to implement low emission hydrogen in partial replacement of coal and coke in primary steel production as well as natural gas in secondary and DRI-EAF production.

The most significant improvement to the reduction of carbon-based emissions likely will result from the incorporation of biocarbon with biohydrogen to replace coal at any point coal or coke is currently used during the steel process. This is best achieved by developing biocarbon that can seamlessly replace coal without modification to the infrastructure or process conditions. Several short-term demonstration trials utilizing biocarbon at full scale have occurred across the steel industry in the U.S. and abroad with minimal issues. The challenge is developing the capital intensive biocarbon industry to meet the demand of the metals industry as this biotechnology will likely play a significant role in decarbonization of the steel industry. This challenge of fossil decarbonization of steel will only be achieved by the co-development of biohydrogen and biocarbon for use in the steel process.

Politically, the European Union (EU) is accelerating policy-based penalties with the approval of the Carbon Border Adjustment Mechanism (CBAM) in April 2023. CBAM completely phases out the free emissions allowances for steel production by 2035 [4]. The United States Inflation Reduction Act passed in 2022 also has incentives to encourage renewable hydrogen production and CCUS technologies.

Hydrogen Technologies

Hydrogen is the proposed energy vector of a fossil-free, decarbonized future. How is the steel industry incorporating hydrogen technologies into its green steel product lines?

The primary hydrogen-based technology replaces coking coal with hydrogen during reduction to remove oxygen from the iron ore pellets. Hydrogen is applied at 1000°C as a reducing agent into a shaft furnace with the iron ore pellets, producing only water vapor as a by-product. The produced direct reduced iron (DRI), also known as sponge iron, is then melted in an Electric Arc Furnace, and further processed into steel. The sponge iron can also be hot-briquetted for use in a Blast Furnace-Basic Oxygen Furnace.

Another hydrogen-based technology is the partial replacement of pulverized coal injection with hydrogen gas in blast furnace operations. While this technology does not eliminate fossil fuel use, a 15% reduction in CO2 emissions [10] coupled with over 70% of current steel production is in blast furnaces, the reduction in greenhouse gas emissions is impactful. In fact, the carbon footprint of steel production can be reduced completely with biomass based hydrogen from thermochemical process.

The following chart illustrates that the type of hydrogen matters tremendously when trying to reduce the steels CO2 emissions. While hydrogen from natural gas (NG) provides significant reduction, green hydrogen from electrolysis of water powered by renewable energy and biomasss based biogreen hydrogen have potential to negate CO2 emissions completely. Note that hydrogen from electrolysis utilizing grid electricity may actually increase emissions and generally should be avoided.

Typically, hydrogen is replacing natural gas and coal mostly for process heat, but also as a chemical reductant of ore. Other areas in the steel-making process can further utilize hydrogen technologies including pelletizing, annealing, heat treatment, steeling coating, and the use of hydrogen as cutting gas.

Industry Leaders

SSAB, a Swedish steel manufacturer, is an industry forerunner with its expected availability of Fossil-free steel starting in 2026, using its HYBRIT technology to replace coal with green hydrogen in the reduction process, and SSAB Zero steel products using recycled scrap.

ArcelorMittal, the world’s largest steel company, in addition to CCUS methods, is implementing two pathways: hydrogen DRI-EAF technologies and the use of bio-based Smart Carbon in blast furnace-basic oxygen furnace steel making.

Japan’s Nippon Steel has been researching several avenues to carbon reduction: hydrogen reduction in blast furnaces, high-grade steel production in large-sized EAFs, 100% hydrogen use in the direct reduction process, and CCUS. US company Steel Dynamics exclusively uses EAFs versus the more carbon-intensive blast furnaces.

Challenges

A critical challenge to decarbonization of steel is the industrial availability and cost of green hydrogen. Presently, the steel industry is taking a “green hydrogen-ready” approach. The initial development phases will rely upon grey or blue hydrogen produced via steam reforming of natural gas, and transition over to green hydrogen sources as supply increases and cost decreases.

The amount of renewable energy required for the global steel energy switch over to hydrogen produced via electrolysis is approximately 40% of the entire 2022 global renewable energy production [6,7]. To fully decarbonize steel at today’s steel production rate of 2,000 Mt/yr would require 15.7 Mt of hydrogen per year and 680 Mt of biocarbon per year. The current production of all hydrogen is near 100 Mt/yr with less than 1% or 1 Mt/yr from low-emission hydrogen production processes with most consumed by the transportation sector. The current production of biocarbon is about 75 kt/yr with the majority dedicated to agricultural applications. More growth is needed in biohydrogen (15x) and the related biocarbon production (9,000x) if the steel industry is to fully decarbonize globally.

Another hurdle to implementation is the cost-effectiveness and safety of hydrogen transportation and storage. Ideally, centralized large-scale industrial hydrogen users like steel can produce the hydrogen on-demand and on-site or transport it efficiently by pipeline from nearby production facilities.

Recent growth in steel production operations have implemented blast furnace operations in emerging economies. With an approximate equipment lifetime of 40 years and modern furnaces optimized close to the minimum energy possible, Net-Zero by 2050 must include strategies to improve existing infrastructure. These facilities may have more financial advantages to using CCUS technologies to meet any governmental or regulatory requirements versus investing in new hydrogen-based facilities.

China, India, Japan, United States, Russia, and South Korea are the global leaders in steel production, with China currently producing over half of the world’s steel. To achieve an economically viable and sustainable transition to green steel, a cooperative global mission needs to involve all the major steel-producing nations.

Conclusions

The steel industry is a crucial piece to a decarbonized future, both by reducing its own footprint and by being a key material supplier in the renewable energy migration to wind turbines, solar cells, electrolysis units, hydrogen pipelines, and biofuel facilities. While carbon emissions associated with steel production have historically posed environmental and engineering challenges, recent advancements in technology and sustainable practices are shaping a more promising future.

About the Author

Daren E. Daugaard, PhD, PE, has over 20 years of experience in thermo-chemical conversion technologies and serves as a Project Director at Lee Enterprises Consulting, overseeing matters involving Pyrolysis, Gasification, Torrefaction, Biochar, Bio-fuels, Life Cycle Assessments, and Techno-Economic Analysis.

About Lee Enterprises Consulting: Lee Enterprises Consulting was founded in 1995, and has grown to become the world’s premier consulting group specializing in the bioeconomy with over 170 experts around the globe. The group’s experts are renowned, hand-selected leaders, with over 97% holding advanced degrees and averaging over 30 years in their respective fields.”

References:

[1] Stubbles, J. 2000. Energy use in the U.S. Steel Industry: An Historical Perspective and Future Opportunities. https://www.energy.gov/eere/amo/articles/itp-steel-energy-use-us-steel-industry-historical-perspective-and-future#:~:text=With%20an%20average%20of%20770,2.

[2] IEA: Steel. Accessed November 2023. https://www.iea.org/energy-system/industry/steel

[3] Berger, R. The future of steelmaking – How the European steel industry can achieve carbon neutrality. May 2020. Focus.

[4] EU Steel Emissions to See Higher Penalties as Free Allowances Get Taken Away. August 24, 2023. https://www.spglobal.com/commodityinsights/en/market-insights/blogs/metals/082423-eu-steel-emissions-to-see-higher-penalties-as-free-allowances-get-taken-away

[5] de Oliveira, E. M., et. al. A Numerical Study of Scenarios for the Substitution of Pulverized Coal Injection by Blast Furnace Gas Enriched by Hydrogen and Oxygen Aiming at a Reduction in CO2 Emissions in the Blast Furnace Process. Metals 2023, 13(5), 927; https://www.mdpi.com/2075-4701/13/5/927

[6] Wallach, O. Green Steel: Decarbonising with Hydrogen-Fueled Production. September 28, 2022. https://www.visualcapitalist.com/sp/green-steel-decarbonising-with-hydrogen-fueled-production/

[7] Expansion of renewable power generation in 2022 confirms upward trend of renewables against declining new fossil fuel capacity. March 21, 2023. https://www.irena.org/News/pressreleases/2023/Mar/Record-9-point-6-Percentage-Growth-in-Renewables-Achieved-Despite-Energy-Crisis#:~:text=Abu%20Dhabi%2C%20United%20Arab%20Emirates,or%20by%209.6%20per%20cent.

General References:

[A] Europa, B. Hydrogen in steel production: what is happening in Europe – Part One and Two May 21 and May 26, 2021. https://bellona.org/news/eu/2021-05-hydrogen-in-steel-production-what-is-happening-in-europe-part-two

[B] Hydrogen sparks change for the future of green steel production. July 19, 2023. https://www.ing.com/Newsroom/News/Hydrogen-sparks-change-for-the-future-of-green-steel-production.htm#:~:text=The%20transformative%20hydrogen%20route,of%20iron%20and%20CO2.

[C] Collins, L. Green hydrogen: ‘Average EU steel plant would need a whopping 1.2GW of electrolysers and 4.5GW of solar to decarbonise’. July 22, 2022. https://www.rechargenews.com/energy-transition/green-hydrogen-average-eu-steel-plant-would-need-a-whopping-1-2gw-of-electrolysers-and-4-5gw-of-solar-to-decarbonise/2-1-1265531

[D] IEA. Iron and Steel Technology Roadmap: Towards more sustainable steelmaking. https://iea.blob.core.windows.net/assets/eb0c8ec1-3665-4959-97d0-187ceca189a8/Iron_and_Steel_Technology_Roadmap.pdf

[E] Promotion of innovative technology development. Nippon Steel. Accessed November 2023. https://www.nipponsteel.com/en/csr/env/warming/future.html

d, PhD, PE, Lee Enterprise Consulting

Since its inception over 4,000 years ago, steel has been the foundation of global modernization in building construction, transportation, and manufacturing. Steel and iron production ranks first in total global CO2emissions at 8% and second in overall energy consumption. The industry must pivot aggressively and innovatively to meet modern challenges regarding emission prescribed by the Net-Zero Emissions by 2050 initiative.

Steel manufacturing is a high-temperature and energy-intensive operation that relies on fossil-based fuels for raw materials (coking coal) and process heat (coal, natural gas, grid electricity). Since WWII, a significant reduction in energy intensity has been achieved by utilizing iron ore pellets, exchanging open hearth processes primarily with blast furnace-basic oxygen furnace (BF-BOF) and secondarily by electric arc furnaces (EAF), obsoleting ingot casting with continuous casting, and increasing the scrap recycling rate [1,2]. The gains in reducing energy intensity have been offset by increased steel demand while CO2emissions average from 1.4 to 1.9 tCO2eq/tsteel in recent times.

Current Initiatives to Net-Zero Emissions

The industry has a multifaceted approach to reducing its carbon footprint by: Improving the energy efficiency of existing infrastructure, increasing secondary production with the use of recycled scrap in EAF, transitioning process heat from fossil fuel to renewable sources, implementing carbon capture utilization and storage (CCUS) technologies, developing hydrogen-based processes, and utilizing biobased carbon sources.

Using secondary production methods with recycled scrap uses about 10% to 15% of the energy consumed in primary production using BF-BOF from iron ore. The energy source for secondary production is primarily electricity for EAFs, versus coal in primary production. Steel has high recycling rates of 80-90% yet recycling alone cannot meet present or future demand.

Steel Producing Pathways.

Modified from: [3] Berger, R. The future of steelmaking – How the European steel industry can achieve carbon neutrality. May 2020.

| Steel Process | Iron Ore | Coal/Coke

Carbon |

Natural Gas | Electricity | Recycled Steel | CO2

Emissions |

World Fraction | |

| BF-BOF (primary) | 1,577 kg | 482 kg | 0.5 kg | 154 kWh | 165 kg | 1.69 t | ~70% | |

| EAF (secondary) | – | 10.4 kg | 28 kg | 623 kWh | 1,116 kg | 0.30 t | ~25% | |

| DRI-EAF | 1,363 kg | – | 221 kg | 452 kWh | 165 kg | 0.74 t | ~5% | |

| Based on: Metals 2020, 10, 331; doi:10.3390/met10030331

Note: Near 0.4 kgH2 to replace 1 kgNatural Gas when decarbonizing the steel process. |

||||||||

Traditional Steel Production Inputs and Emissions (per tonne of steel)

The previous table illustrates opportunities to implement low emission hydrogen in partial replacement of coal and coke in primary steel production as well as natural gas in secondary and DRI-EAF production.

The most significant improvement to the reduction of carbon-based emissions likely will result from the incorporation of biocarbon with biohydrogen to replace coal at any point coal or coke is currently used during the steel process. This is best achieved by developing biocarbon that can seamlessly replace coal without modification to the infrastructure or process conditions. Several short-term demonstration trials utilizing biocarbon at full scale have occurred across the steel industry in the U.S. and abroad with minimal issues. The challenge is developing the capital intensive biocarbon industry to meet the demand of the metals industry as this biotechnology will likely play a significant role in decarbonization of the steel industry. This challenge of fossil decarbonization of steel will only be achieved by the co-development of biohydrogen and biocarbon for use in the steel process.

Politically, the European Union (EU) is accelerating policy-based penalties with the approval of the Carbon Border Adjustment Mechanism (CBAM) in April 2023. CBAM completely phases out the free emissions allowances for steel production by 2035 [4]. The United States Inflation Reduction Act passed in 2022 also has incentives to encourage renewable hydrogen production and CCUS technologies.

Hydrogen Technologies

Hydrogen is the proposed energy vector of a fossil-free, decarbonized future. How is the steel industry incorporating hydrogen technologies into its green steel product lines?

The primary hydrogen-based technology replaces coking coal with hydrogen during reduction to remove oxygen from the iron ore pellets. Hydrogen is applied at 1000°C as a reducing agent into a shaft furnace with the iron ore pellets, producing only water vapor as a by-product. The produced direct reduced iron (DRI), also known as sponge iron, is then melted in an Electric Arc Furnace, and further processed into steel. The sponge iron can also be hot-briquetted for use in a Blast Furnace-Basic Oxygen Furnace.

Another hydrogen-based technology is the partial replacement of pulverized coal injection with hydrogen gas in blast furnace operations. While this technology does not eliminate fossil fuel use, a 15% reduction in CO2 emissions [10] coupled with over 70% of current steel production is in blast furnaces, the reduction in greenhouse gas emissions is impactful. In fact, the carbon footprint of steel production can be reduced completely with biomass based hydrogen from thermochemical process.

The following chart illustrates that the type of hydrogen matters tremendously when trying to reduce the steels CO2 emissions. While hydrogen from natural gas (NG) provides significant reduction, green hydrogen from electrolysis of water powered by renewable energy and biomasss based biogreen hydrogen have potential to negate CO2 emissions completely. Note that hydrogen from electrolysis utilizing grid electricity may actually increase emissions and generally should be avoided.

Typically, hydrogen is replacing natural gas and coal mostly for process heat, but also as a chemical reductant of ore. Other areas in the steel-making process can further utilize hydrogen technologies including pelletizing, annealing, heat treatment, steeling coating, and the use of hydrogen as cutting gas.

Industry Leaders

SSAB, a Swedish steel manufacturer, is an industry forerunner with its expected availability of Fossil-free steel starting in 2026, using its HYBRIT technology to replace coal with green hydrogen in the reduction process, and SSAB Zero steel products using recycled scrap.

ArcelorMittal, the world’s largest steel company, in addition to CCUS methods, is implementing two pathways: hydrogen DRI-EAF technologies and the use of bio-based Smart Carbon in blast furnace-basic oxygen furnace steel making.

Japan’s Nippon Steel has been researching several avenues to carbon reduction: hydrogen reduction in blast furnaces, high-grade steel production in large-sized EAFs, 100% hydrogen use in the direct reduction process, and CCUS. US company Steel Dynamics exclusively uses EAFs versus the more carbon-intensive blast furnaces.

Challenges

A critical challenge to decarbonization of steel is the industrial availability and cost of green hydrogen. Presently, the steel industry is taking a “green hydrogen-ready” approach. The initial development phases will rely upon grey or blue hydrogen produced via steam reforming of natural gas, and transition over to green hydrogen sources as supply increases and cost decreases.

The amount of renewable energy required for the global steel energy switch over to hydrogen produced via electrolysis is approximately 40% of the entire 2022 global renewable energy production [6,7]. To fully decarbonize steel at today’s steel production rate of 2,000 Mt/yr would require 15.7 Mt of hydrogen per year and 680 Mt of biocarbon per year. The current production of all hydrogen is near 100 Mt/yr with less than 1% or 1 Mt/yr from low-emission hydrogen production processes with most consumed by the transportation sector. The current production of biocarbon is about 75 kt/yr with the majority dedicated to agricultural applications. More growth is needed in biohydrogen (15x) and the related biocarbon production (9,000x) if the steel industry is to fully decarbonize globally.

Another hurdle to implementation is the cost-effectiveness and safety of hydrogen transportation and storage. Ideally, centralized large-scale industrial hydrogen users like steel can produce the hydrogen on-demand and on-site or transport it efficiently by pipeline from nearby production facilities.

Recent growth in steel production operations have implemented blast furnace operations in emerging economies. With an approximate equipment lifetime of 40 years and modern furnaces optimized close to the minimum energy possible, Net-Zero by 2050 must include strategies to improve existing infrastructure. These facilities may have more financial advantages to using CCUS technologies to meet any governmental or regulatory requirements versus investing in new hydrogen-based facilities.

China, India, Japan, United States, Russia, and South Korea are the global leaders in steel production, with China currently producing over half of the world’s steel. To achieve an economically viable and sustainable transition to green steel, a cooperative global mission needs to involve all the major steel-producing nations.

Conclusions

The steel industry is a crucial piece to a decarbonized future, both by reducing its own footprint and by being a key material supplier in the renewable energy migration to wind turbines, solar cells, electrolysis units, hydrogen pipelines, and biofuel facilities. While carbon emissions associated with steel production have historically posed environmental and engineering challenges, recent advancements in technology and sustainable practices are shaping a more promising future.

About the Author: Daren E. Daugaard, PhD, PE, has over 20 years of experience in thermo-chemical conversion technologies and serves as a Project Director at Lee Enterprises Consulting, overseeing matters involving Pyrolysis, Gasification, Torrefaction, Biochar, Bio-fuels, Life Cycle Assessments, and Techno-Economic Analysis.

About Lee Enterprises Consulting: Lee Enterprises Consulting was founded in 1995, and has grown to become the world’s premier consulting group specializing in the bioeconomy with over 170 experts around the globe. The group’s experts are renowned, hand-selected leaders, with over 97% holding advanced degrees and averaging over 30 years in their respective fields.”

References:

[1] Stubbles, J. 2000. Energy use in the U.S. Steel Industry: An Historical Perspective and Future Opportunities. https://www.energy.gov/eere/amo/articles/itp-steel-energy-use-us-steel-industry-historical-perspective-and-future#:~:text=With%20an%20average%20of%20770,2.

[2] IEA: Steel. Accessed November 2023. https://www.iea.org/energy-system/industry/steel

[3] Berger, R. The future of steelmaking – How the European steel industry can achieve carbon neutrality. May 2020. Focus.

[4] EU Steel Emissions to See Higher Penalties as Free Allowances Get Taken Away. August 24, 2023. https://www.spglobal.com/commodityinsights/en/market-insights/blogs/metals/082423-eu-steel-emissions-to-see-higher-penalties-as-free-allowances-get-taken-away

[5] de Oliveira, E. M., et. al. A Numerical Study of Scenarios for the Substitution of Pulverized Coal Injection by Blast Furnace Gas Enriched by Hydrogen and Oxygen Aiming at a Reduction in CO2 Emissions in the Blast Furnace Process. Metals 2023, 13(5), 927; https://www.mdpi.com/2075-4701/13/5/927

[6] Wallach, O. Green Steel: Decarbonising with Hydrogen-Fueled Production. September 28, 2022. https://www.visualcapitalist.com/sp/green-steel-decarbonising-with-hydrogen-fueled-production/

[7] Expansion of renewable power generation in 2022 confirms upward trend of renewables against declining new fossil fuel capacity. March 21, 2023. https://www.irena.org/News/pressreleases/2023/Mar/Record-9-point-6-Percentage-Growth-in-Renewables-Achieved-Despite-Energy-Crisis#:~:text=Abu%20Dhabi%2C%20United%20Arab%20Emirates,or%20by%209.6%20per%20cent.

General References:

[A] Europa, B. Hydrogen in steel production: what is happening in Europe – Part One and Two May 21 and May 26, 2021. https://bellona.org/news/eu/2021-05-hydrogen-in-steel-production-what-is-happening-in-europe-part-two

[B] Hydrogen sparks change for the future of green steel production. July 19, 2023. https://www.ing.com/Newsroom/News/Hydrogen-sparks-change-for-the-future-of-green-steel-production.htm#:~:text=The%20transformative%20hydrogen%20route,of%20iron%20and%20CO2.

[C] Collins, L. Green hydrogen: ‘Average EU steel plant would need a whopping 1.2GW of electrolysers and 4.5GW of solar to decarbonise’. July 22, 2022. https://www.rechargenews.com/energy-transition/green-hydrogen-average-eu-steel-plant-would-need-a-whopping-1-2gw-of-electrolysers-and-4-5gw-of-solar-to-decarbonise/2-1-1265531

[D] IEA. Iron and Steel Technology Roadmap: Towards more sustainable steelmaking. https://iea.blob.core.windows.net/assets/eb0c8ec1-3665-4959-97d0-187ceca189a8/Iron_and_Steel_Technology_Roadmap.pdf

[E] Promotion of innovative technology development. Nippon Steel. Accessed November 2023. https://www.nipponsteel.com/en/csr/env/warming/future.html

Category: Hydrogen, Thought Leadership, Top Stories