Decarbonizing the Shipping Industry

By Wily Salim, LEC Partners

Special to The Digest

Approximately 71% of Earth’s surface is covered by water, which makes shipping a vital mode of transportation. The earliest known seafaring can be traced back to 6,000 BC, when ancient civilizations, such as the Egyptians, began using boats to transport goods and people across water bodies. From Christopher Columbus discovering the new world, the majestic Titanic and the demise on its maiden voyage, globalization allowing trade across the world, and maritime warfare, shipping has been filled with adventure, tragedy, and innovation, all of which have transformed humanity over time. One point of consideration is the impact shipping has on global warming due to greenhouse gas emissions.

Power sources that ships use also change over time due to technological advancement, as well as increasing load and longer voyages. From raw muscle power, to relying on wind as propulsion, to burning coal powering steam engines, to using fossil-based fuel feeding internal combustion engines, and to the latest trends in utilizing biofuel to effectively reduce the release of and impacts from GHG emissions, energy requirements must be met to ensure these oceanic trips can be accomplished. Being stranded without fuel in the middle of the vast ocean isn’t desirable for anyone or any ship.

Current Fuel Options & Future Trajectory

The future trajectory of the world’s energy outlook would be heavily influenced by agriculture, just as much as it had a significant historical supportive role on civilization and population growth on Earth millenniums ago. As much of the coal, oil, and gas dug out of the ground are biomass matters, their energy derivatives are classified as fossil-based due to their extremely slow regeneration cycles. Hence, biomass matters from agriculture, having a much shorter rejuvenation timeframe, could be key raw materials to replace the above-mentioned orthodox feedstocks in fueling our shipping activities into the future.

The shipping industry contributes approximately 3-4% of global GHG emissions, and tighter regulation from the International Maritime Organization (IMO) on decarbonization targets and customer demand will be two major factors in the growing pressure that marine logistic companies will face. This increasing pressure to stay commercially competitive whilst reducing its environmental impacts has started to drive some major industry participants to adopt new ways to reduce their GHG emissions. The topic of marine GHG emissions is broad, and hence, this blog will focus on scope 1, which is related to the type of fuel being combusted onboard commercial ships, in particular sea freight.

Heavy Fuel Oil (HFO), a more dense and more viscous liquid than diesel, is the current dominant fuel used in the marine shipping industry. This is because HFO is relatively affordable, has high energy density, is relatively easy to transport, and requires only simple storage infrastructure. However, it comes at a cost due to its high Sulphur content and many other impurities. HFO causes pollution via the release of NOx, SOx, and black carbon when combusted. Hence, the industry has investigated alternative fuels to find the best solution to fix this issue.

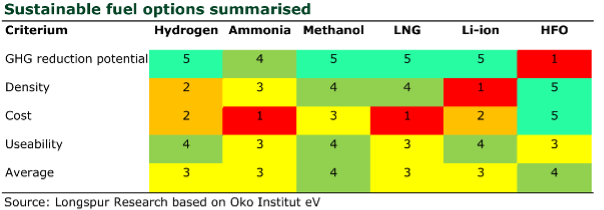

Figure 1: Summary of sustainable marine fuel options assessed against key performance indicators.

Figure 1 lays out key parameters in determining the most suitable current solutions in the quest to lower marine GHG emissions. Battery technology is unable to provide close to on-par energy density required, and compounded by the relatively expensive costs to purchase, replace, and recharge, electric heavy-duty ships will certainly not be seen any time soon.

While gaseous alternatives such as hydrogen, ammonia, and LNG provide additional fuel options, their associated costs for transportation, storage in pressurized vessels, and overall energy densities remain inferior to a liquid substitute, methanol. Methanol provides a pathway for shipping industry companies to decarbonize, as it is conventionally produced from natural gas, a cleaner fuel resource than HFO, albeit still a fossil-based derivative.

In addition to the parameters inherent to these alternative fuel types, important aspects to consider are the supply infrastructure and specific engine requirements. Storing and transporting liquid versus gas fuel differs vastly. Gaseous fuel requires the operation of compressors and pressurized vessels to reduce its volumetric footprint. Both are of higher financial burden than using existing pumps and storage tanks both on land and on-board vessels.

Green Methanol & Industry Trends

Building new ships or retrofitting engines in existing ships to exploit the benefits of methanol in reducing emissions will be needed. This is a critical deciding factor for marine operators, as it has significant commercial implications. Above choosing liquid over a gas-fueled engine that helps reduce up-front and operational costs, retrofitting ships further helps minimize scope 3 emissions from shipbuilding activities across its entire value chain. This can be observed from the decision made by Maersk, which has ordered 25 new methanol-fueled ships with plans to retrofit existing liquid-fueled fleets into dual-fuel capability.

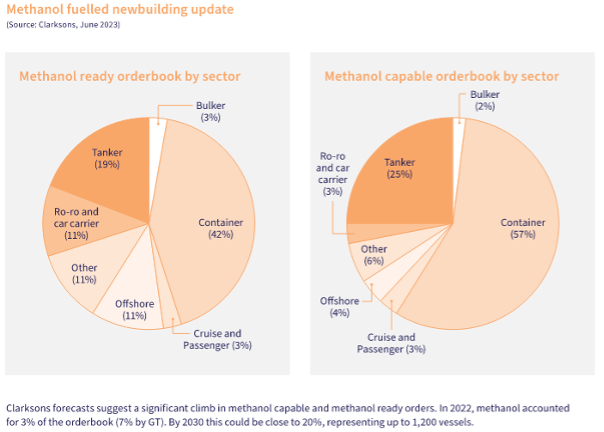

Figure 2: Diagrams showing Methanol ready and capable vessels order book by sector.

As depicted and in addition to Figure 2 above, Clarksons, a global leader in maritime and shipping research services, reports that as of June 2023, there are 29 methanol-fuel-capable vessels in operation and 112 on order, along with 3 methanol-ready vessels operating and 128 on order. By 2030, it is forecast that up to 1,200 vessels represent close to 20% of the order book that would be methanol-ready and methanol-capable ships combined.

With methanol being the current marine fuel favorite, efforts have now turned to how methanol can be produced with minimal ecological effects from renewable sources instead of fossil fuel. Biomethanol (methanol produced from biomass) and e-methanol (methanol synthesized from captured carbon and renewable power sources) are two “green” methanol supply options being explored, with projects across the globe being ramped up to cater and catch up to the increasing gap from demands of the marine industry.

This drive to green methanol production has an additional benefit: It also presents a much-needed potential to help decarbonize the chemical industry, as those in this domain typically use fossil-based methanol. With its diverse applications, methanol is one of the highest-traded chemical commodities. Therefore, the opportunity to decarbonize the chemical sector is also large, which may compete for the same currently scarce commodity.

Marine logistic companies will likely purchase green methanol, as the current bunkering costs are around USD$500-700/mt. Methanol’s drawback is that it has a lower energy density than its fossil-based counterparts. The gap in the costs per unit of marine fuel energy would need to be compensated by the carbon market regulated by international bodies and intergovernmental organizations, in addition to possible premiums supported by cargo owners looking for a greener sea freight options to lower GHG emissions on their overall business operations.

Feedstock & Technology

In the production of green methanol, there are many factors critical to a successful project delivery, such as:

- Feedstock compatibility with available technology,

- Choice of technology which could affect barrier to entry,

- Amount of raw materials and its long-term sustainability affecting economies of scale,

- Source and type of energy consumed across the entire well-to-tank value chain, and

- Geographical locations of feedstock and processing unit.

- All of the above but not limited to these, which would determine overall net unit production costs, total carbon intensity of the end product and its associated GHG emission reductions from its fossil-based counterparts as well as overall CAPEX and OPEX required.

In general, as mentioned above, there are two (2) types of green methanol: biomethanol and e-methanol. Biomethanol production requires carbonaceous biomass feedstock with high calorific value, while e-methanol needs surplus renewable energy and carbon capture.

From the lens of an agri-energy perspective in biomethanol production, the adage of competition for food and fuel never goes away. Therefore, biomass classification is important, as it is important to avoid using 1st generation edible biomass wherever possible.

Depending on the feedstock, there are 2 major technological pathways to biomethanol production, which are:

Feeding of synthetic gas, containing hydrogen and carbon monoxide with a minimum 2:1 ratio, produced by gasification of carbonaceous biomass feedstock into a copper or zinc oxide catalytic methanol reactor.

Steam methane reforming (SMR) of biogas, predominantly biomethane, produced from anaerobic digesters fed with organic materials.

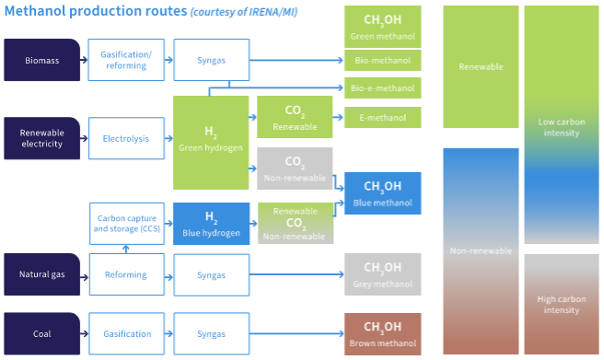

Figure 3: Production pathways for different types of methanol and its associated carbon intensity.

Figure 3 depicts the current technological pathway and feedstock used in the production of methanol globally. The information presented highlights significant opportunities in the usage of alternative renewable feedstock in methanol synthesis which has considerable positive impacts on the decarbonization of marine shipping and many other industries that are dependent on it as raw material.

Currently, about two-thirds of global methanol production uses natural gas via the SMR pathway, while the remaining one-third uses coal via gasification methodology. With less than 1% of global methanol production using biomass and renewables, significant demand arising from marine applications will be a major driving force in the transition from fossil-based methanol to green methanol in the next few decades.

Unlike fossil fuels, where large reserves tend to be the norm, biomass feedstock derived from agriculture activities requires collection to a central processing unit due to its widespread nature. This collection operation is vital, as it potentially could be a financially costly exercise, with the likelihood of tipping the balance of a project’s feasibility both in its financial terms and the carbon intensity output of any biofuel product. Hence, the concentration of biomass feedstock availability for a geographic area with minimal transportation costs to a nearby port facility is of utmost importance for a scaled biomass-to-biofuel project.

Carbon Intensity & Certifications

Life cycle analysis (LCA) is mandatory in any renewable energy project, and the production of green methanol is no exception. Outputs from LCA would be inputs for carbon credit accounting, which could subsequently add value for project owners and off-takers if the carbon intensity of the replaced fuel is higher than its biofuel substitute.

This is a scientific domain, with practicing experts and companies in the global market offering such services to help account for and audit carbon emissions associated with all activities involved in the production of renewable energy outputs.

A common terminology and basis for LCA of marine fuels in assessing emissions from ships is “well-to-wake”, not “tank-to-wake.” This is for reasons that a given biofuel on face value might have a significant reduction in carbon intensity from its fossil-based counterpart. However, should its upstream manufacturing processes consume more energy, and GHG release from its associated activities is significant, this could potentially render the use of that biofuel more damaging to the environment than the reverse.

In addition, a negative change in carbon intensity on a well-to-wake basis when substituting marine fuel with renewable products coupled with a favorable carbon price is the epitome of our collective efforts to promote an economy that is circular with net zero emissions.

Certification of renewable energy products is paramount to ensure that critical data and information are captured quantitatively and qualitatively across its value chain. Such data would be inputs for LCA assessment and a mandatory requirement expected by potential off-takers. Two commonly recognized international standards for sustainable fuel certification are ISCC and RSB. Hence, for any project developers wanting to supply biofuel in the global market, understanding and execution of ISCC and RSB requirements is non-negotiable.

The Exciting Future

As humanity progresses into the future, plotting the dots forward, new ideas always bloom, and with that both the known and unknown are constantly being re-evaluated and discovered. Just like how plastics are now considered a damaging invention by some, despite the original intention to save animals from being hunted for ivory, horn, linen, etc. Albeit this negative apprehension, plastics will not return to Pandora‘s box, and humanity with its God-given ingenuity will have to devise engineering feats to contain and reverse the undesirable impacts of plastics on the environment.

This will be like biofuel production, which is being geared up across the globe, in that there would be unforeseen unwanted side effects that we would eventually discover and need to solve. In the meantime, imagination and work are actualizing to realize the utilization of captured carbon emissions from biomethanol combustion in marine engines, coupled with renewable energy availability in nearby offshore or onshore facilities to regenerate biomethanol for further and circular usage.

Demystifying the prospect of an offshore oil & gas platform retrofitted to be a biomethanol production and ship refueling facility harnessing both seaweeds cultivated around and underneath it, with plastics polluting the ocean captured as renewable feedstock, could soon be a dream come true.

In the context of decarbonizing the shipping industry, alternative fuels must be examined to reduce scope 1 emissions, with a comprehensive consideration of GHG impacts across its entire value chain. As technology advances over time, the emergence of new technology will likely allow additional fuel options to surface and be adopted such as ammonia provided safety measures and engine design progress to full acceptance by the industry and its relevant regulators. For the foreseeable future, however, the best available option with current widespread adoption is methanol, with a strong tendency for the demand for biomethanol and e-methanol.

About the Author

Wily Salim is an engineer with a BE (Chemical) from the University of Melbourne. He has diverse experience working with a global construction and real estate company in commissioning Major Hazard Facility processing propellants for the Australian government and constructing World-class properties in Barangaroo: the most prominent office towers in Australia and the 71-story Crown Sydney Hotel Resort. Wily is currently focusing on accelerating decarbonization efforts in Indonesia and regionally in Southeast Asia. His passions are energy efficiency assessment, renewable energy generation, solving critical MSW issues, and generating waste into biofuels.

About LEC Partners

Lee Enterprises Consulting has over 180 experts that can help navigate your bioeconomy needs. If you need assistance with your bio project(s), please Contact Us.

.

Category: Thought Leadership, Top Stories