The Status of US Hydrogen Hubs

By Bob Starkey, LEC Partners (formerly Lee Enterprises Consulting)

Special to The Digest

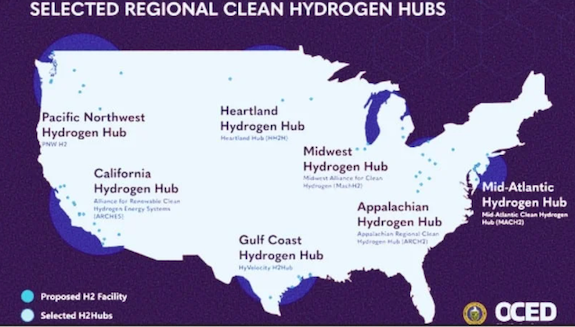

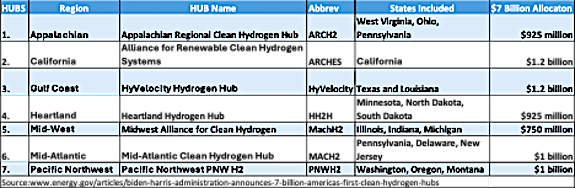

In October 2023 the Biden Administration announced a USD $7B investment in clean hydrogen production. This historic program, known as the Regional Clean Hydrogen Hubs (H2Hubs), selected 7 locations across the U.S. to develop clean hydrogen infrastructure. The H2Hub concept is important because it creates organized networks that bring together various stakeholders involved in the production, distribution, and utilization of clean hydrogen. These hubs are designed to accelerate the development and adoption of clean hydrogen by leveraging the advantages of industrial clustering (1). However, many in the hydrogen industry are still wondering when and how the money will be disbursed, when will they start adding hydrogen production to the economy, as well as key information regarding the participants and focus areas of each H2Hub.

Show Us the Money

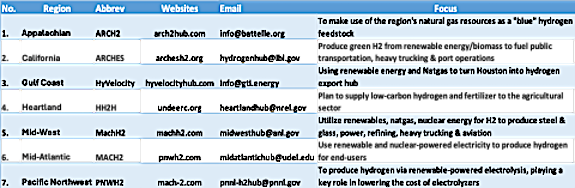

Once the initial excitement of the H2Hubs announcement had passed, the first question the industry asked was when will we see the money? The short answer to that is not immediately, but the longer answer requires some detail. Since the entire award period for the H2Hubs spans approximately 8 to 12 years, depending on the details and complexity of each cluster, some H2Hubs will receive their allocation sooner than others, but for most, not in this decade (See Figure 1 below for the basic information on each of the seven H2Hubs). As of July 2024, most H2Hubs are still waiting clarification on rules for receiving the funds (2). Currently, there is some confusion on structure and application of hydrogen production credits in another key piece of legislation, Section 45V of the Inflation Reduction Act (45V). Final 45V guidance is forthcoming from Treasury Department and should define which types of projects will be eligible for H2 production credits. The final guidance could have a significant impact on the viability of several H2Hubs projects and could result in the cancellation of any hydrogen projects dependent on nuclear energy.

Figure 1. 7 regional HUBS and $7 billion in allocations

Outlining a Phased Approach

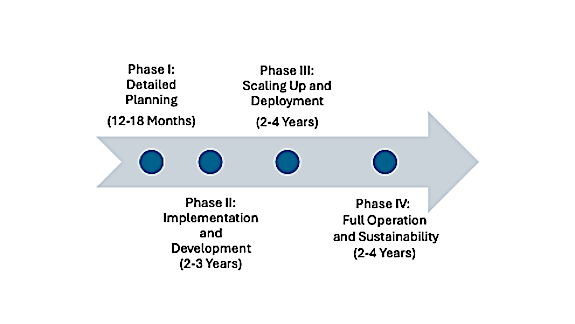

The final decision from the Treasury Department notwithstanding, before the bulk of the money to H2Hubs is distributed, the organizations leading the execution of each regional H2Hub must complete three of four phases. The first phase is the detailed initial planning phase for which the DOE will supply up to $20 million for each H2Hub to complete (3). The four phases are broken down as follows:

- Phase I: Detailed Planning. In this initial phase, each hub receives funding of up to $20 million to complete detailed planning, feasibility assessment, and establishing the groundwork for the Hub’s operations. Expected to take 12 to 18 months, Phase 1 requires input from all the H2Hub’s regional stakeholders. This may be a challenge for the larger H2Hubs, for example California’s ARCHES has over 400 partners and stakeholders, including participating community governments. Therefore, ARCHES has almost as many participants the number of Congressmen in the U.S. House of Representatives, creating a bureaucracy that will require some effort to manage. The completion and complexity of each effort will depend on hydrogen production methods, locations, logistics and hydrogen usage and how they all interact with the regional communities.

- Phase II: Implementation and Development. After plans are completed, the H2Hub moves into the implementation and development phase. Depending on the design of the Hub, Phase II will take 2 to 3 years covering development, permitting, and securing required financing. Each H2Hub is required to provide a minimum of 50% non-federal cost share funding before they receive any Federal funds. The actual amount received from the allocation for this phase will be negotiated between the HUB and the DOE.

- Phase III: Scaling Up and Deployment. After the final investment decisions are made, the HUB’S scale up operations, which include constructing hydrogen production capacity, and setting up regional hydrogen distribution to the final users, creating the regional Hydrogen HUB’s ecosystem. Phase III is estimated to take 2 to 4 years.

- Phase IV: Full Operation and Sustainability. The goal is to achieve self-sufficient commercial scale operation, including ongoing maintenance, with state or private sector support, operating independently of federal funds. 2 to 4 years are estimated for Phase IV.

Figure 2. Phases of H2Hubs Deployment

Evaluating HUB Progress for further funding

DOE only initially authorizes funding for Phase I, with the granting of each subsequent phase of funding depending on progress made against the Hub’s planned goals. The H2Hub’s evaluation at each phase is designed to ensure successful implementation and create economic growth, while maintaining environmental sustainability that benefits communities within the Hub, depend on five key criteria (4):

- Criterion 1: Technical Merit and Impact (weight 25%): Assesses the H2Hub’s ability to deploy infrastructure and produce at least 50-100 metric tons of clean hydrogen per day, along with the proposed reduction of greenhouse gas emissions through hydrogen production and utilization.

- Criterion 2: Financial and Market Viability (weight 20%): Assesses the growth potential and market competitiveness of the proposed H2Hub. Also includes the viability of financial models and sustainability impacts.

- Criterion 3: H2HUB’s Work Plan (weight 15%): Evaluates the detailed work plans, including engineering designs, business development, site access, and permitting, in alignment with the overall goals of the H2HUB’s program.

- Criterion 4: Management Team and Project Partners (weight 20%): Reviews the expertise, qualifications, and experience of the management team, along with strength of partnerships with relevant stakeholders.

- Criterion 5: Community Benefits Plan (weight 20%): Considers community engagement efforts and benefits including socioeconomic impact, job creation, and local community well-being.

The H2HUB’s and the organizations executing the plans need to consider all these factors, social and economic, to progress through the DOE funding phases.

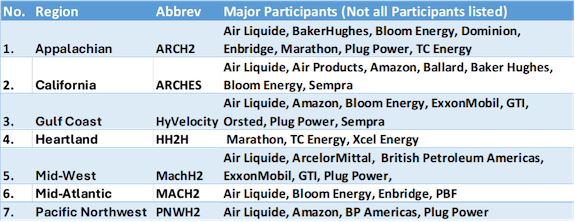

Who is participating

Meeting all the above-mentioned criteria requires an important coalition of partners, stakeholders and participants to execute each phase. The Biden Administration encourages industrial partners, community organizations, and other stakeholders to participate and contribute to a clean hydrogen energy ecosystem. Again, this is especially important since Phase I requires input from all the H2Hub’s regional stakeholders and a minimum of 50% non-federal cost share. Interested parties can join a H2Hub by contacting the Hub directly (most of the seven websites offer a sign-up tab).

Figure 3: Major H2Hub Participants

The current principals and stakeholders for each individual H2Hub are listed on the individual Hub websites. It is worth noting that US hydrogen producer Air Liquide is listed as a stakeholder in all seven H2Hubs. Two other large industrial gas producers, Air Products and Linde Plc, are each active in H2Hubs including Gulf Coasts HyVelocityhub. Air Products is also active in California’s ARCHES and operates hydrogen pipelines and Gulf Coast hydrogen storage facilities. All three of these industrial gas producers have large green and blue hydrogen projects under development in several locations across the country.

Many other participants in the hydrogen sector are stakeholders in several H2Hubs. Bloom Energy, a manufacturer of solid oxide fuel cells, is participating in four Hubs, including its home base in California, Alliance for Renewable Clean Hydrogen Systems (ARCHES), in the Appalachian Regional Clean Hydrogen Hub (ARCH2), Gulf Coast Hub (HyVelocityhub) and the Mid-Atlantic Clean Hydrogen Hub (MACH2). Plug Power, which produces PEM electrolyzers as well as hydrogen distribution and dispensing equipment, is also participating in four H2Hubs: Appalachian, Gulf Coast, Mid-West Alliance for Clean Hydrogen (MachH2) and Pacific Northwest (PNW H2). Amazon, a user of Plug Powers hydrogen system for operating forklifts at its many warehouses, is participating in at least three Hubs: Gulf Coast, Pacific Northwest and California.

Many oil companies are also participating in H2Hubs, including ExxonMobil, PBF, Shell, British Petroleum, Canada’s Enbridge, and Denmark-based Orested. Notable utility companies participating in Hubs where they are active include Dominion Energy in Appalachian and Sempra Energy in California and the Gulf Coast.

Focus Areas of the H2Hubs

Given that there are several ways of producing low-carbon hydrogen, e.g. electrolysis from renewables, steam methane reforming with carbon capture, electrolysis from nuclear energy, etc., the seven regional H2Hubs have different focus areas that align with the resources and infrastructure that already exist within each region. Figure 4 below provides a short description of the focus areas for each of the H2Hubs, as well as the websites and primary contact information for each (5, 6).

Figure 4: H2Hub’s Focus Areas

Key Takeaways on the H2Hubs

The development of US hydrogen hubs is underway, but their full realization will take considerable time. While the Department of Energy has allocated $7 billion for the H2Hubs, the deployment of these funds will be spread over the next decade, with the majority not being disbursed for several years. Critical to understanding the H2Hubs is the phased approach outlined by the DOE, which allows for careful planning and implementation. This approach includes stages for concept development, detailed planning, and final construction and operation. However, potential risks exist, such as technological challenges, market uncertainties, and the need for significant private investment to complement federal funding. For instance, the success of these hubs will partly depend on the terms of the Clean Hydrogen Production Tax Credit (Section 45V), which has sparked debate among industry stakeholders, environmental organizations, and policymakers regarding the qualifying criteria for “green” and “clean” hydrogen production. Despite these challenges, the H2Hubs program represents a significant step forward in creating a national clean hydrogen network, with the potential to substantially contribute to decarbonizing multiple sectors of the economy.

LEC Partners continuously monitors the activities of these seven H2Hubs, as well as other key hydrogen development projects, so please reach out to us for additional information.

About the Author:

Bob Starkey has an MBA in International Management (Thunderbird School of Global Management), a BA degree in Chemistry, and over 30 years of experience in petrochemicals, biofuels, and fuel components trading – in the US and internationally. He is the former president of a petrochemical trading company specializing in polymer resins, fuel components, MTBE, 2EOH, ethanol, methanol, and engineering grade resins, has worked in chemical trading and business development for Mitsubishi International Corporation, LyondellBasell and served as the Director of Biofuels for Kingsman, SA, a Swiss provider of price information and analytic for the sugar and biofuels markets.

Most recently, Bob worked as Feedstock and Energy Manager at Continental Carbon a U.S. carbon black manufacturer. He has also worked as a market analyst and managing editor with Jim Jordan & Associates, a provider of price reporting and market intelligence to the methanol and transportation fuels markets. Bob has written and edited numerous industry market reports, including a worldwide, multi-client, ethanol study. He has also authored multiple ethanol and biodiesel studies and has expertise in purchasing and selling products in the carbon black, heavy fuel oil, biofuels, fuel components, and plastics resin markets, including PE, PP, PHA, PLA and other biobased resins. Bob also brings extensive operational experience in logistics and supply chain management for these types of products and is fluent in Spanish.

About LEC Partners (formerly Lee Enterprises Consulting). LEC Partners has over 180 experts to help you navigate your bioeconomy needs. If you need assistance with your bioeconomy-related project(s), please get in touch with us at www.lee-enterprises.com.

References:

- The Rocky Mountain Institute “Why We Need Hydrogen Hubs” (https://rmi.org/why-we-need-hydrogen-hubs/)

- Cleantechnia “US Makes $7 Billion Available For Hydrogen Hubs” (https://cleantechnica.com/2023/10/16/us-makes-7-billion-available-for-hydrogen-hubs/)

- Clean Task Air Force “U.S. hydrogen hubs: What comes next?” https://www.catf.us/2023/04/us-hydrogen-hubs-what-comes-next

- Resources Magazine “Promoting Hydrogen: The Plan for Evaluating Hydrogen-Hub Project Proposals” (https://www.resources.org/common-resources/promoting-hydrogen-the-plan-for-evaluating-hydrogen-hub-project-proposals/)

- Hydrogen Insight “US reveals the seven regional Hydrogen Hubs to receive $7bn of government funding” (https://www.hydrogeninsight.com/production/us-reveals-the-seven-regional-hydrogen-HUB’s-to-receive-7bn-of-government-funding/2-1-1534596)

- S&P Global “Gas utilities take step toward hydrogen future with DOE hub selections” (https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/gas-utilities-take-step-toward-hydrogen-future-with-doe-hub-selections-77956246)

Category: Top Stories