Biofuels M&A: 2023 Review & Outlook: A Thriving Industry, But Few M&A Deals

By Bruce Comer, Frank Kim, Zak Putlak, and John Panvica, Ocean Park

Special to The Digest

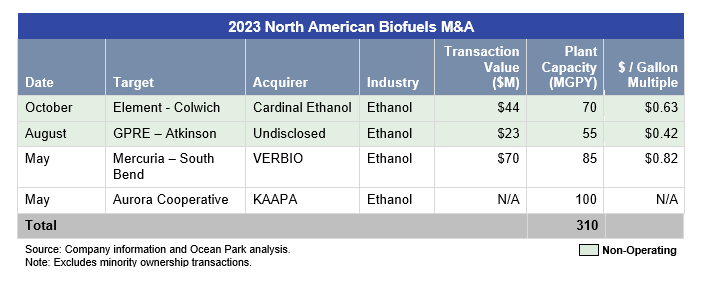

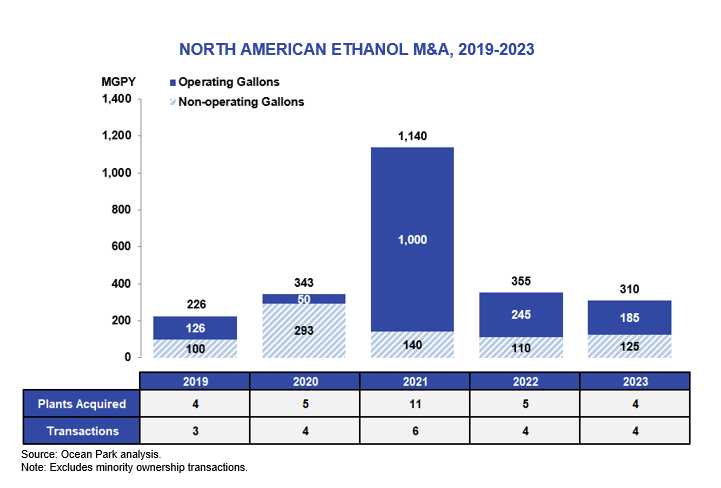

The US biofuels sector in 2023 registered the flourishing of new technologies and billions in new investments – and an unprecedented low level of M&A activity: only two operating biofuels plants and two non-operating plants, worth 310 million gallons per year (MGPY) of plant capacity. All the M&A activity occurred in ethanol. There were no deals in renewable diesel (RD) or biodiesel (BD).

Investors placed significant bets on the industry continuing to prosper, but the M&A market was spooked by the uncertainty of the tax credit implementation, an uptick in ethanol profitability, the shifting dynamic between RD and BD, and the new structure and ownership of RD plants. Ultimately, these factors resulted in irreconcilable valuation gaps between buyers and sellers. Ocean Park was aware of and advised on several transactions that could not find a market-clearing price and structure.

While all was quiet on the M&A front, companies committed billions of dollars to strategic joint ventures, new greenfield construction, refinery conversions, plant expansions, feedstock investments, and carbon capture & sequestration (CCS) initiatives.

Ethanol M&A

Note: Excludes minority ownership transactions.

In 2023, ethanol M&A volume was below average. Only two operating and two non-operating plants changed hands. The four transactions involved four plants with 310 MGPY of combined capacity:

- VERBIO bought South Bend Ethanol from Mercuria Investments. VERBIO, a German biofuels producer, acquired South Bend Ethanol from Mercuria Investments. The 85 MGPY plant in South Bend, Indiana added a second ethanol plant to VERBIO’s North American fleet.

- Green Plains sold its ethanol plant in Atkinson, Nebraska. Green Plains completed the sale of its 55 MGPY non-operating ethanol plant in Atkinson, Nebraska for $22.9 million to an undisclosed buyer. The sale reduced Green Plains’ total production capacity six percent to 903 MGPY, across 10 ethanol plants. Green Plains remains the fourth largest ethanol producer in the US.

- Cardinal Ethanol acquired substantially all of the assets of Element, LLC. Cardinal Ethanol acquired Element’s 70 MGPY non-operating ethanol plant in Colwich, Kansas for $44 million through a bankruptcy.

- KAAPA acquired a majority interest in Aurora Cooperative’s ethanol plant in Aurora, Nebraska. KAAPA Ethanol and Aurora Cooperative closed on a joint venture, forming KAAPA Partners Aurora, LLC which will operate the 100 MGPY ethanol plant and grain facilities located west of Aurora, Nebraska. With this deal, KAAPA added a third Nebraska plant to its fleet while Aurora retained a minority interest through the new company.

The above analysis does not include a minority ownership transaction in which Dakota Ethanol acquired an ownership stake from KAAPA in Guardian Energy’s ethanol plant in Hankinson, North Dakota.

There were several reasons for the lack of ethanol M&A deals. Notably, sellers’ valuation expectations were higher than buyers were willing to pay. Sellers set their valuations based on increased future cash flows from the not-yet defined Inflation Reduction Act (IRA) decarbonization; buyers balked. High margins, upwards of $0.40 per gallon, further incentivized owners to hold on to their plants and drove sellers’ valuation expectations higher.

Another explanation for the lull in deal activity is that many ethanol plant owners and boards are actively considering or have committed to major capital investments (in the tens of millions of dollars), targeted at net-zero decarbonization and product diversification, which divert resources that could be used to make acquisitions.

US ethanol producers are exploring carbon capture and storage options to profit from IRA policy incentives. However, details of the plan have not been finalized, fueling volatility in ethanol plant valuations because the timing and amount of benefits are still unknown. Some of the announced CCS pipelines have had slow starts – Navigator canceled its Heartland Greenway pipeline project, and Summit Carbon Solutions is delaying its expected start date to 2026 due to regulatory headwinds. Meanwhile, two on-site storage projects became operational – Red Trail Energy and Harvestone / Blue Flint Ethanol in North Dakota.

Biodiesel & Renewable Diesel M&A

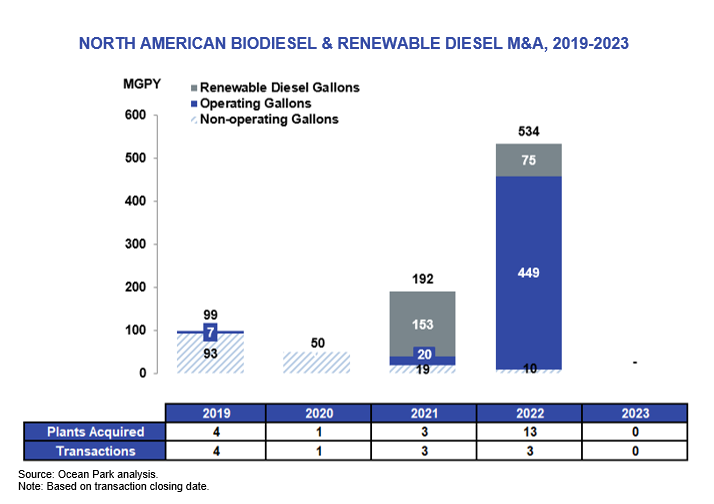

Following a standout year for biodiesel and renewable diesel M&A in 2022 due to Chevron’s acquisition of REG, no operating plants changed hands in 2023.

The only M&A activity that OP tracked was a result of the Ryze Renewables bankruptcy. Ryze had been developing two RD plants in Nevada that were never commissioned. Camber Energy acquired Ryze’s unfinished project near Reno, and Edgewood Renewables acquired the project in Las Vegas.

There were many developments in biomass-based diesel (BBD) in 2023, just not in M&A. See inset box “2023 RD Construction & Feedstock Implications in M&A”.

In BD, there are few independent plants. The large, integrated soy crushers that produce BD now account for two-thirds to three-fourths of the BD produced in the US. After Chevron’s acquisition of REG in 2022, only a dozen or fewer commercial-scale, independent plants remain. There is a limited pool of buyers for these plants as well.

In RD, capacity has rapidly increased to account for 59% of the BBD gallons produced in the US. However, most of these plants are oil refineries converted to RD by large oil refiners or integrated oil companies who intentionally designed production capacity to meet compliance obligations. The result is little appetite or strategic rationale for selling RD plants.

Furthermore, in an industry that is looking like it has surplus production capacity, the RD producers along with other players are focusing their resources on buying existing or building new feedstock sources. Ocean Park forecasts 8.5 billion pounds of additional soybean oil to hit the market from 2023 through 2026, enough to produce 1.1 BGPY of RD.

2023 CCS Implications in M&A

2023 RD Construction & Feedstock Implications in M&A

Billions of dollars are being invested into the BBD sector, just not in M&A. BBD producers continue to focus investments on RD construction projects. RD plants totaling 735 MGPY of capacity commenced operations in 2023, with another 1.6 BGPY expected to come online in 2024. These new plants represent billions of dollars invested mostly by traditional oil refiners into RD production. Almost all these new plants are owned by obligated parties / oil refiners.

In addition to the RD buildout, BBD producers are spending billions on controlling feedstock. One recently announced joint venture was Marathon Petroleum and ADM partnering on a $350 million soybean processing complex. In 2023, soybean crushers announced expansions or new construction of 790 million bushels of new annual capacity by 2026, accounting for $5.8 billion of total investment. Ocean Park has tracked 20 feedstock transactions between RD producers and feedstock providers since 2020.

One consequence of increasing RD production has been an oversupply of advanced biofuels renewable identification numbers (RINs) and Low Carbon Fuel Standard (LCFS) credits, resulting in shrinking margins on BBD production. This lower profitability environment could contribute to the reluctance by buyers to consolidate and pursue acquisitions.

North American Biofuels Outlook for 2024

Regulatory

In June, the EPA released its final Renewable Fuel Standard (RFS) “set” rule for 2023 to 2025, setting market sizes for ethanol, RD and BD for the next two years. For 2024, the total renewable volume obligation (RVO) will be 21.54 billion gallons inclusive of 6.54 billion gallons of advanced biofuel, 3.04 billion gallons of BBD, and 1.09 billion gallons of cellulosic biofuel. The RVO is set to expand to 22.33 billion gallons in 2025. Notably, advanced biofuels is the biggest winner, increasing 23% by more than 800 million gallons from 2023 to 2025. However, those BBD RVOs are growing at a much lower rate than the projected increase in capacity coming online through 2025. By 2024, obligated parties are expected to already have the capacity to fulfill their entire obligation under the advanced biofuels RVO. This could continue to exacerbate the supply-demand imbalance in RINs.

In 2024, the U.S. Department of Treasury and Internal Revenue Service are expected to finalize rulemaking on many of the tax credits in the IRA that will impact the biofuels sector, including Section 40B SAF Credit, 45Z Clean Fuel Production Credit, and 45Q Carbon Sequestration Credit. Biofuels producers and related parties will keep a keen watch as final implementation will have a significant impact on investments and market dynamics.

In California, among the proposed amendments to California Air Resource Board’s (CARB) LCFS program is accelerating the carbon intensity reduction targets which will increase the size of the CA LCFS market. If this comes to fruition, biofuels producers believe the value of the state’s credits will increase above the low 2023 levels, improving the economics of those who sell biofuels in the state.

Ethanol

If ethanol producers enjoy robust margins this year as they did in 2023, M&A deal volumes could again suffer. If not, sellers may be enticed by numerous active buyers. Notably, the IRA and ethanol-to-SAF have drawn interest from both financial and European investors, which could trigger more deals. The wide range of reinvestment strategies for plant product diversification and decarbonization may also lead to future M&A. Costs for product diversification along with decarbonization to net-zero would require significant capital investment; and if ethanol producers lack the capital or if financing remains difficult to secure, plants could continue to consolidate to the well-capitalized producers.

BBD

As production volumes continue to increase to fulfill the increasing RVO, we expect RD to grab a higher percentage. Independent RD plants might be involved in M&A activity. For example, Vertex Energy recently announced a sales process. The excess supply within the BBD sector could reveal a wide range of profitability across plants, thereby spurring M&A. A couple of independent BD producers are currently testing the market. Some of those deals could close in 2024.

Conclusion

Biofuels M&A activity in 2023 was below historical levels due to wide bid-ask spreads, high ethanol margins, capital projects and BBD companies focusing on RD construction and securing feedstock. While little M&A activity took place, the industry continues to draw billions of investor dollars a year. We expect select strategic M&A in an industry that remains vibrant and growing in a policy environment looking to decarbonize liquid fuels.

About Ocean Park

Ocean Park is a leading boutique investment bank focused on industry segments across the agricultural supply chain including the ag inputs, renewable fuels and chemicals, energy, food, and AgTech sectors. The Ocean Park team has significant operational and transaction experience, including advising on mergers and acquisitions, financings and restructurings. Since its founding in 2004, Ocean Park has successfully completed over 80 transactions and client engagements, including over 37 biofuels transactions. Its offices are in Los Angeles and Minneapolis.

This material is solely for informational purposes. The information in this document does not constitute an offer to sell, or a solicitation of an offer to purchase, any security or to provide any investment advice. Any securities are offered through Ocean Park Securities, LLC, a member of FINRA and SIPC. Ocean Park’s professionals are licensed registered representatives of Ocean Park Securities, LLC. For more information, please visit oceanpk.com or call (310) 670-2093.

Category: Top Stories