The Bioeconomy Risk Indexes launched by The Daily Digest and Digest Data

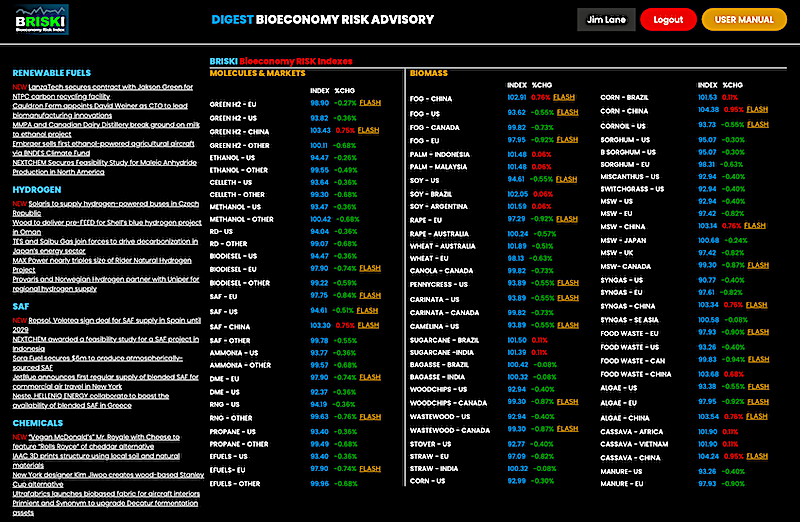

In Florida, Digest Data launched the BRISKIs, the Bioeconomy Risk Indexes, tracking risk for 30 bioeconomy fuels and chemical molecules, and 60 feedstocks. They are free, and here.

The purpose

The BRISKIs offer insight for decision makers, at a time in the bioeconomy when the industry turns from development to deployment, and risks are a deterrent to investment, and uncertainty about risk levels is a call to inaction and slows deployment.

The decision makers

Investors, financiers, policymakers, traders, project developers, scientists, supply-chain players, feedstock providers, off-takers, and end-users. They want to know the path of least resistance to bioeconomy capacity building, the smoothest path to affordable prices, and the lowest risk projects to back.

What do the BRISKIs measure?

The BRISKIs measure changes in risk and specifically, changes in supply and demand and macroeconomic and industry conditions that influence risk. For example. capacity coming online and offline, changes in product mix, new applications that drive demand, shifts in feedstock usability and availability, changes in carbon prices, deal flow. Also, macro economic trends such as interest rates, currency shifts, GDP changes and more.

How are the BRISKIs reported?

As of June 1st, when we began tracking risk internally with the BRISKIs, all feedstocks and molecules were at 100 representing the risk baseline. When the Index declines, that means less risk, which is a positive. When the Index increases, that means more risk, which is a negative. So, it’s a little like golf, the lower the score, the better. Since June, we’ve seen risk shift for individual molecules and feedstocks, and the 90 individual indexes now range between values of 92.99 and 104.38. Typical movements are in the 0.2-1.2% range each week.

How do the BRISKIs measure risk?

First of all, there’s a dedicated Digest Data team tracking newsflow and global data, making (at this time) weekly updates as supply and demand shift and risk changes.

Second, we feed the data into a proprietary risk algorithm that scores and weights the changes seen in the data and news-stream, making it possible to compare qualitative and quantitative events.

Who manages the algorithms?

First of all, the industry does. Throughout this spring, we asked Digest readers in a series of public surveys to evaluate risk elements and their importance. They told us what to score as impactful on risk, and how to weight the impact.

Secondly, we are fortunate to have a ten-member Risk Advisory Board, consisting of senior, high-profile project developers, owner/operators, financiers, attorneys, broker/dealers, policy analysts, and equity analysts. Some of them have and will be identifying themselves to the public at ABLC and through other means, some are staying in the background due to their company policies. The Risk Advisory Board continues to advise us on what to measure and how to weight the risk elements, as markets and the industry evolves.

Also, we will continue our series of Bioeconomy Risk Surveys and listen carefully to the views of our Digest readers. And we will always welcome any support or advice from any quarter in measuring risk better.

How to use a BRISKI Index to evaluate risk

When it comes to individual projects, we have our series of Project Risk Ratings which we debuted in March 2024, and you can learn more about those here.

The BRISKI indexes look at molecules and feedstocks, and readers can mix and match their technologies to see where the risks are rising, where they are falling, for potential combinations of feedstocks and products. For example, right now in the BRISKIs we are seeing rising risks for using corn as a feedstock in China, but falling risks for using corn produced in the US. SAF risks are falling in the US, but rising in China, methane risk is dropping but methanol it depends on where the project is.

Where’s more background information?

On the site, you can click in the upper-right of the home page to download the User Manual.

Understanding the changes in detail via FLASH messages

Each week, for molecules and feedstocks seeing a material shift in risk, we write a short FLASH message which you can click to read, containing a short summary of the market movements causing that shift — changes in macro conditions, supply disruption or smoothing, demand spikes or falls, and so forth.

What else is on the Digest Bioeconomy Risk Advisory site?

We have click-to-read, consolidated Digest news feeds for renewable road transport fuels, hydrogen, SAF and Chemicals. Plus, we have links to our latest Deep Dive Slide Guides, the latest programs and episodes on Digest TV, and a link to our Project Risk Ratings for those looking for a more specific, granular look at risks as they pertain to proposed or operating bioeconomy projects.

What’s the cost?

The BRISKIs are free, just register to start tracking them, here.

What’s the background on this effort – why do this?

Following the release of the Biden Administration’s Bold Goals for the Bioeconomy in March 2023 at ABLC, hundreds of volunteers around the world as a coalition of the willing, recognizing that Bold Goals require Bold Actions, formed the Bold Goals Action Group to identify and foster those bold actions that will lead to reaching bold goals.

As one of its 40 Bold Actions the group called for a better understanding of risk so as to remove barriers to speedy deployment, and to understand and report risks on a regular basis and in an easy-to-understand and effective way. The Digest took up that challenge, as a member of the coalition of the willing. We released Project Risk Ratings in March 2024 and are releasing the BRISKIs today.

What molecules and markets are tracked?

GREEN H2 – EU

AMMONIA – OTHER

AMMONIA – US

BIODIESEL – EU

BIODIESEL – OTHER

BIODIESEL – US

CELLETH – OTHER

CELLETH – US

DME – EU

DME – US

EFUELS – OTHER

EFUELS – US

EFUELS- EU

ETHANOL – OTHER

ETHANOL – US

GREEN H2 – CHINA

GREEN H2 – OTHER

GREEN H2 – US

METHANOL – OTHER

METHANOL – US

PROPANE – OTHER

PROPANE – US

RD – OTHER

RD- US

RNG – OTHER

RNG – US

SAF – CHINA

SAF – EU

SAF – OTHER

SAF – US

What are the feedstocks tracked by BRISKI Indexes?

ALGAE – CHINA

ALGAE – EU

ALGAE – US

B SORGHUM – US

BAGASSE – BRAZIL

BAGASSE – INDIA

CAMELINA – US

CANOLA – CANADA

CARINATA – CANADA

CARINATA – US

CASSAVA – AFRICA

CASSAVA – CHINA

CASSAVA – VIETNAM

CORN – BRAZIL

CORN – CHINA

CORN – US

CORNOIL – US

FOG – CANADA

FOG – CHINA

FOG – EU

FOG – US

FOOD WASTE – CAN

FOOD WASTE – CHINA

FOOD WASTE – EU

FOOD WASTE – US

MANURE – EU

MANURE- US

MISCANTHUS – US

MSW – CHINA

MSW – EU

MSW – JAPAN

MSW – UK

MSW – US

MSW- CANADA

PALM – INDONESIA

PALM – MALAYSIA

PENNYCRESS – US

RAPE – AUSTRALIA

RAPE – EU

SORGHUM – EU

SORGHUM – US

SOY – ARGENTINA

SOY – BRAZIL

SOY – US

STOVER – US

STRAW – EU

STRAW – INDIA

SUGARCANE – BRAZIL

SUGARCANE -INDIA

SWITCHGRASS – US

SYNGAS – CHINA

SYNGAS – EU

SYNGAS – SE ASIA

SYNGAS – US

WASTEWOOD – CANADA

WASTEWOOD – US

WHEAT – AUSTRALIA

WHEAT – EU

WOODCHIPS – CANADA

WOODCHIPS – US

Whose tax dollars were spent in creating and managing the BRISKIs?

None! The BRISKs were created and are maintained without government or public support of any kind. This has been a volunteer effort by — our Digest team with the support and insight of Digest readers who responded to our risk surveys, our Risk Advisory Board members, and those who are laboring within the Bold Goals Action Group. We do appreciate anyone’s support to spread the word that the bioeconomy is working hard on measuring risk. What you can measure, you can manage.

What about other molecules, feedstocks and geographies?

We will expand the coverage over time. We started with a duanting set of 90 Indexes to create and manage, over time, we hope to have many more.

More on the story

The Digest Bioeconomy Risk Advisory site, and the BRISKIs, are here. It’s a quick and free registration.

Category: Top Stories